Nelson Airport and Port Nelson provide key gateways to the Nelson Tasman Region.

Nelson Airport and Port Nelson provide key gateways to the Nelson Tasman Region.

Both are essential partners for many businesses, with most exports leaving the region either by sea or air. Jointly owned by us and Tasman District Council, they are important strategic assets that are vital to the ongoing economic and social wellbeing of our communities.

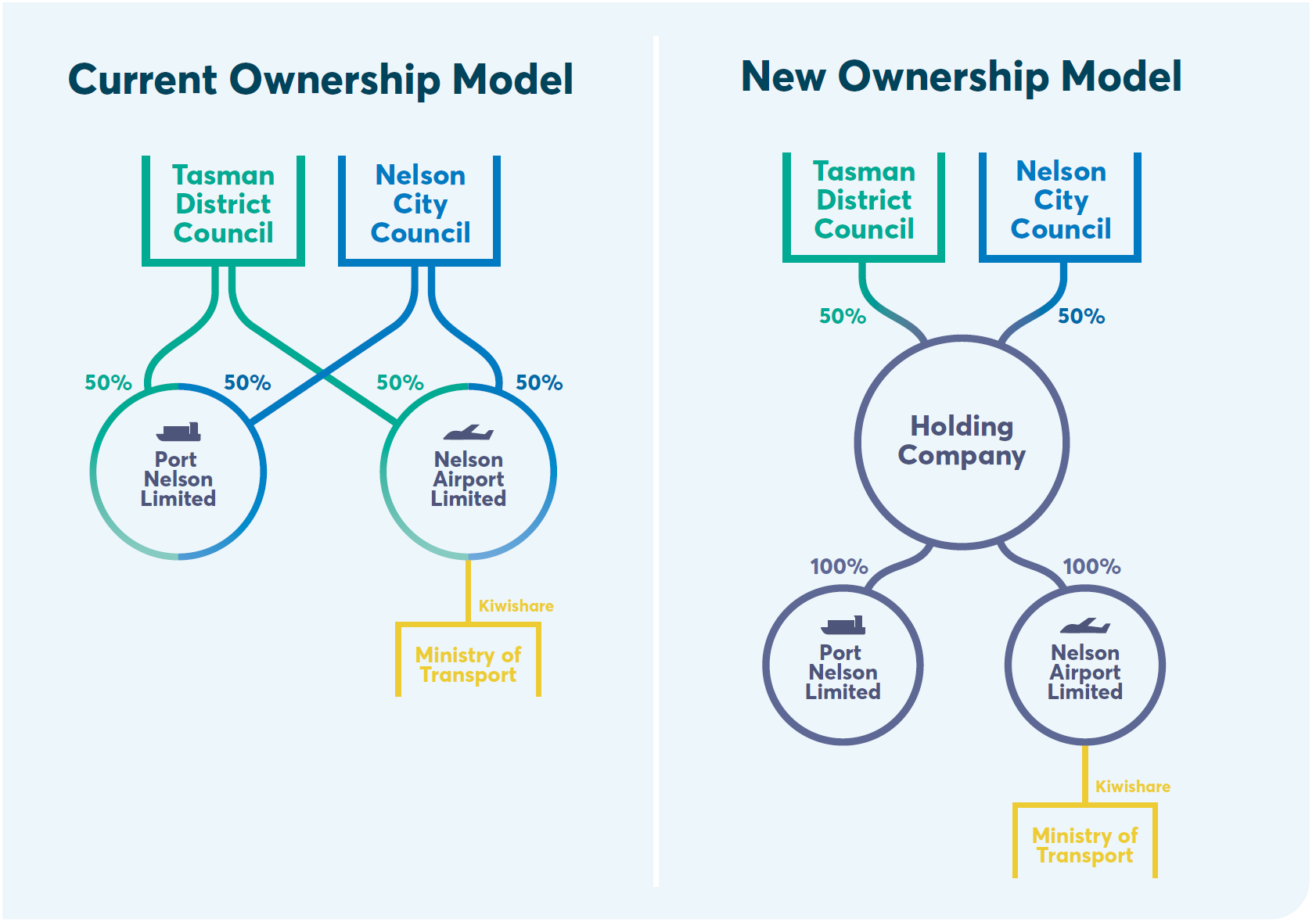

Together we are jointly proposing to transfer our shareholdings in both Nelson Airport Limited and Port Nelson Limited into a single new company. The company will be set up as an operational holding company, and will be 50% owned by us and 50% owned by Tasman District Council.

The Ministry of Transport will continue to own one share in Nelson Airport, the ‘Kiwishare’.

The reason for the proposed change is that there are many positive benefits that would arise from the new structure both to the companies and to the Council shareholders. These include operational efficiencies, cheaper borrowing, tax efficiencies and increased resilience for the two companies. The benefits to the Councils include better governance, potential debt reduction and increased future dividends. This approach will also help to mitigate some of the risks arising from economic uncertainties.

The reason for the proposed change is that there are many positive benefits that would arise from the new structure both to the companies and to the Council shareholders. These include operational efficiencies, cheaper borrowing, tax efficiencies and increased resilience for the two companies. The benefits to the Councils include better governance, potential debt reduction and increased future dividends. This approach will also help to mitigate some of the risks arising from economic uncertainties.

As part of the business proposal, seven alternative options were considered by both Councils. These were narrowed down to four reasonably practicable options. The preferred option is seen to offer the best value for the Council shareholders, while also keeping risk to an acceptable level. The options not progressed further included: asset transfer; share transfer; and changing the funding mechanism to allow Local Government Funding Agency (LGFA) borrowing through the shareholders.

Any change in the current structure of the companies is conditional on both Councils agreeing to proceed. A final decision will not be made before 30 June 2021, when both Long Term Plans are due to be adopted.

Our Future

We believe the new structure will bring about significant operational efficiencies and savings. This new ownership model applies to the preferred option and also alternative options C and D.

Further information on the benefits and disadvantages/costs are outlined in the supporting document.

Read the Akersten Synergy Review Summary.

Option 1

To establish a new company for holding the investments in, and overseeing operations of, Nelson Airport and Port Nelson – with Council and Tasman District Council as equal shareholders. (Council’s and Tasman District Council’s preferred option)

A single Board of Directors, with the necessary range of skills and expertise to operate both the Airport and the Port, will replace the two existing Boards. Under the proposal one Chief Executive Officer and one Chief Financial Officer will be appointed, removing the current duplication across the two companies. A Chief Operating Officer will also be appointed to Nelson Airport, mirroring the existing role in Port Nelson. All other operational aspects of the Airport and Port will remain as they currently are.

One of the main benefits to Council will be reduced borrowing costs for the Port and the Airport, as the new Company will be able to access Local Government Funding Agency (LGFA) loan funding directly, and hold its own debt saving an estimated $900,000 per year. In addition, the level of operational savings is estimated between $592,000 and $942,000 per year, with synergies including savings in payroll, directors’ fees, insurance, IT systems and through joint procurement and the sharing of services. Therefore total savings are estimated to be between $1.492 million and $1.842 million per year.

This proposal does not result in any loss of dilution of either Councils’ overall ownership of Nelson Airport and Port Nelson.

This is the Port Company Board’s preferred option.

Effect on rates: No immediate impact. The new company structure is forecasted to be in a position to increase dividends to shareholders.

Effect on debt: Potential reduction in Council debt levels if, as part of the restructure, there is a release of equity to the shareholders.

Effect on levels of service: No impact.

Note: The effect on rates, debt and levels of service are the same for all options.

Option 2

Status quo

We could retain the current structure, with the Port and Airport remaining independent with their own Boards and management team. The funding structure and costs associated with running and managing the two would remain as they currently are. There would be no operational savings or advantages to either company in terms of funding differentials under this option.

Option 3

A new company established as a funding vehicle only

Under this option we could establish a new Company as a funding vehicle only for the Port and Airport – meaning they could access reduced borrowing costs through the LGFA saving an estimated $900,000 per year. All other aspects of the entities would remain the same, meaning there would be little or no direct operational synergies.

This is the Airport Company Board’s preferred option.

Option 4

A new company established as a funding vehicle and shared services arrangement

As a variation to the alternative option C above, we could establish a new Company to provide a funding vehicle for the Port and Airport and also establish a single Board of Directors with a shared services agreement. Both companies will still have their own CEO’s and executive teams. This provides funding benefits, taxation efficiencies and operational synergies, but the value of operational savings is significantly less than the preferred option with an estimated $167,000 per year compared to $942,000 per year. Therefore, including borrowing cost savings of $900,000, total savings are estimated to be $1.067 million per year.